Services of CCP Austria

CCPA as a Central Counterparty is responsible for the clearing and risk management of all day-ahead electricity spot market transactions executed on the energy exchange platform of EXAA Abwicklungsstelle für Energieprodukte AG. EXAA has been commissioned by Wiener Börse AG in its function as a general commodity exchange with the task of operating the trading system in electricity spot market products.

As the central counterparty, CCPA stands between buyer and seller and in this role, CCPA assumes and manages the settlement and default risk for all trades for all electricity exchange transactions. CCPA is also responsible for the settlement, risk management, management of defaults and the declaration of technical defaults by clearing members.

The trading unit is represented by the megawatt/hour (MWh). The minimal trading unit begins from the 0,1 MWh (0,025 MWh quarter hours products). The trading product portfolio of EXAA can be divided into 5 subgroups:

- Quarter Hours Products

- Single Hours Products

- Block Products

- Spread Products

- Green Power

CCPA maintains both, balancing groups in the control areas of Amprion, TenneT, 50Hertz, TransnetBW (Germany) and a balance group at the control area of APG (Austria), therefore the physical nomination of the executed transactions can selectively be carried out in either the Austrian or in one of the four German control areas. All details can be found at physical delivery.

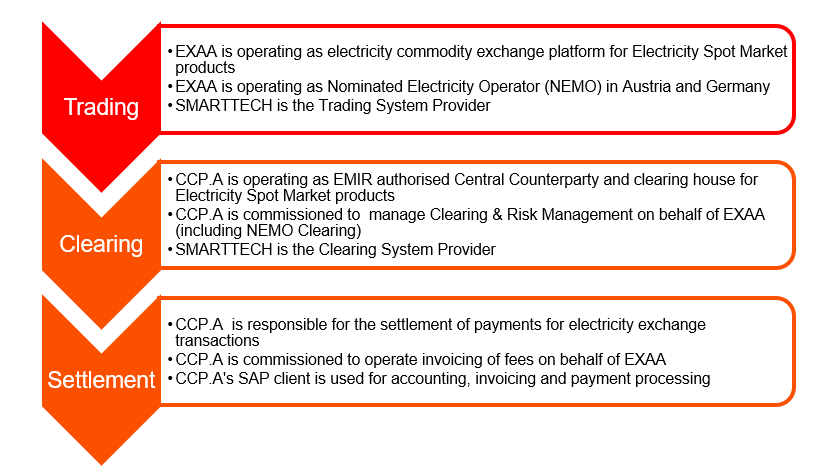

The following graphic shows the distribution of responsibilities for trading, clearing and settlement on the electricity market: